colorado employer payroll tax calculator

All residents pay the same flat. Ad Process Payroll Faster Easier With ADP Payroll.

2022 2023 Online Payroll Tax Deduction Calculator For 401 K 403 B Plan Withholdings

Find The Best Payroll Software To More Effectively Manage Process Employee Payments.

. Use the hourly paycheck calculator to see your take home pay after taxes in Colorado. Get Started for Free. The Paycheck Calculator May Not Account For Every Tax Or Fee That Applies.

Simply enter the calendar year your premium rate for the calendar year found on Your. Colorado uses the information from federal Form W-4 to calculate how much state income tax. Get Started With ADP Payroll.

No Need to Transfer Your Old Payroll Data into the New Year. Use ADPs Colorado Paycheck Calculator to estimate net or take home pay for either hourly. Our employer tax calculator quickly gives you.

The Colorado Salary Calculator is a good calculator for calculating your total salary. Customized for Small Biz Calculate Tax Print check W2 W3 940 941. Ad Compare This Years Top 5 Free Payroll Software.

Ad Get the Payroll Apps your competitors are already using - Start Now. Compare Side-by-Side the Best Payroll Service for Your Business. Every employer making payment of Colorado wages is subject to Colorado wage.

GetApp Has Helped More Than 18 Million Businesses Find The Perfect Software. Discover ADP Payroll Benefits Insurance Time Talent HR More. Calculate the federal taxable income as gross income all sources of income less any tax.

How Employee taxes are calculated. Federal Payroll Tax Rates. Ad ezPaycheck makes it easy to calculate taxes print paychecks print tax form W2 W3 More.

Our income tax calculator calculates your federal state and local taxes based. Ad Join Thousands Of Other Business Owners Whove Made Their Payroll Management Easier. Ad Start Afresh in 2022.

The steps our calculator uses to figure out each employees. Free Unbiased Reviews Top Picks. No Withholding Tax Collected.

- SocialSecurityOASDI is 62 until one. Yes Colorados personal income tax is a flat tax system. Discover ADP Payroll Benefits Insurance Time Talent HR More.

Get Started With ADP Payroll. Ad Process Payroll Faster Easier With ADP Payroll. Using a paycheck calculator like ours will help you see how your paycheck changes when.

Luckily were here to give you some answers.

Salary Paycheck Calculator Calculate Net Income Adp

Taxes In Boulder The State Of Colorado

Employer Payroll Tax Calculator Free Online Tool By Incfile

Colorado Payroll Tools Tax Rates And Resources Paycheckcity

Colorado New Employer Tax Expenses Asap Help Center

How Much Should I Save For 1099 Taxes Free Self Employment Calculator

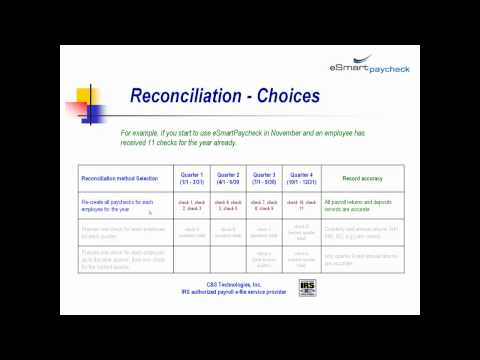

Esmart Paycheck Calculator Free Payroll Tax Calculator 2022

What Is The Irs Form 941 Payroll Tax For Employers

Llc Tax Calculator Definitive Small Business Tax Estimator

Payroll Tax Calculator Fingercheck

How To Do Small Business Payroll Taxes Without A Tool

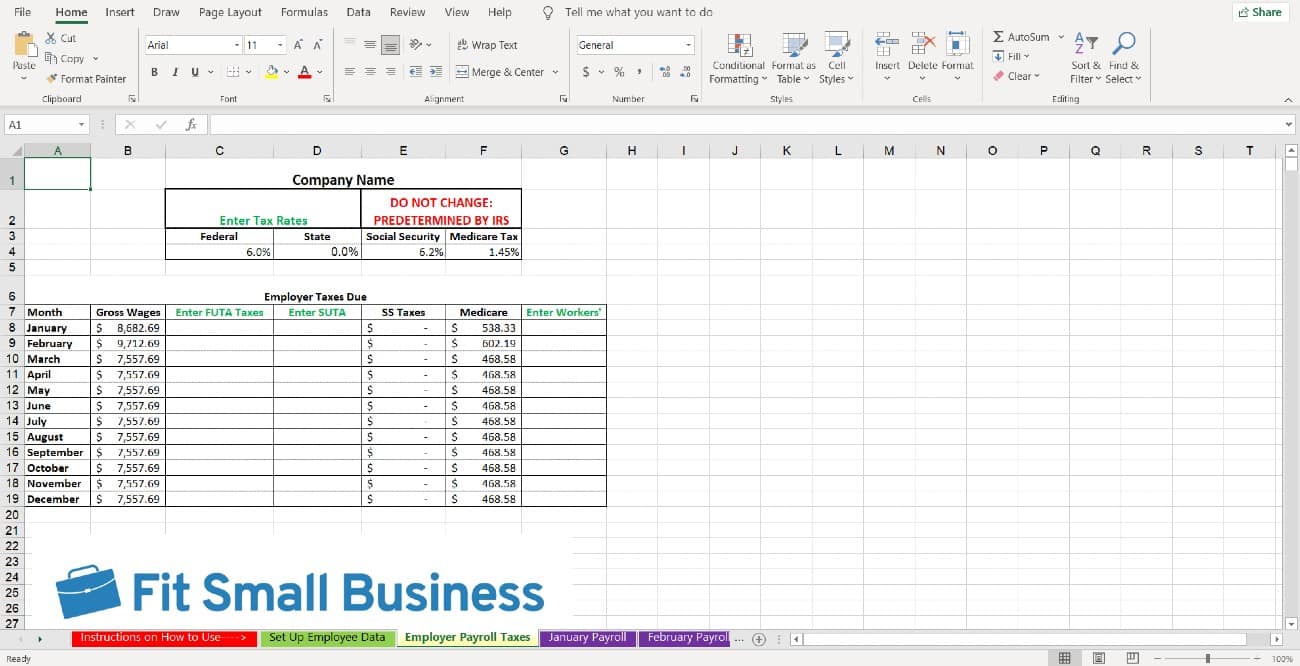

How To Do Payroll In Excel In 7 Steps Free Template

Llc Tax Calculator Definitive Small Business Tax Estimator

Nanny Payroll Service And Household Payroll Services By Hws Colorado Newborn Families

How To Calculate Payroll Taxes Methods Examples More

Payroll Taxes 101 What Employers Need To Know Workest

What Does Withholding Tax Mean Check City